The insurance industry generally looks at clients as either personal or commercial lines. For this article, we will focus on commercial claims. It is concerning that the overall restoration period varies from how each claim is managed. Most businesses have some “loss of income” coverage, which helps them survive until they can continue to build, support, or produce what they did before the loss. The speed it takes to complete the process and the potential of business interruption costs are critical to a successful recovery. Notably, the process of loss management varies by claim.

Many industry clients are still reactive versus proactive, where a client knows who to call before a loss. For larger businesses, business continuity professionals may be on staff or contracted for the specific task of helping a client think through the “What-if” of events that could cripple or threaten the mere existence of the firm. They evaluate the critical functions of a company to understand the threats that could impede those critical functions. For years, IT-oriented response plans were deemed most important. Facility response plans for the threats of fire, flood, and other man-made or natural disasters are next on the list of needs but not always prioritized. As part of a more holistic view of the claim from beginning to end, a design-build management approach could save valuable time and money.

Loss management is most often handled in stages by different people.

- Initial response is generally the first phase, which focuses on mitigating the damage…i.e., extracting water from a pipe leak or flood or a gross cleaning of soot and by-products of a fire.

- Environmental Assessments – Environmental testing may be the next critical step. Is the building safe to occupy? Are the materials free of asbestos-containing materials?

- Engineering – Depending on the extent of the damage, determining the safety of the structure or the integrity of the structural materials with engineers may be a critical next step or, in some cases, the first step.

- Design – Rebuild may require design, permitting, and understanding of the required code upgrades while providing the fastest and most efficient recovery time objective, which is critical to minimize the period of interruption.

- Equipment Assessment – Not only is the time element critical to the loss of business, but it is also critical to understand that business interruption does not replace customers who have gone elsewhere for their supplies, etc. In a structural loss, procuring a contractor to assist with the overall recovery is key. Switchgear, transformers, and other electrical components have long lead times. The earlier determinations can greatly reduce potential downtime. Insurance brokers tell us that determining a rough order of magnitude with a realistic cost to repair is critical for setting reserves and expediting payments. Gaining agreement on steps to move forward is also critical.

- Reconstruction – The construction industry utilizes several management methodologies to perform projects. At GRS, we adhere to a methodology that reduces the time of loss called design-build. It is gaining momentum in the construction industry, but not necessarily in the insurance claims side of construction rebuild. Typically, from a claims adjusting side of the loss, mitigation firms have become the general contractors that work the loss. Engineers, design and architectural firms, equipment restoration firms, and mitigation firms all have the tasks they specialize in. But each is relatively independent. Design-build methodology promotes a teamwork approach that puts all recovery phases on the same team report with a common goal.

Utilizing a design-build methodology provides a great advantage for the owner.

- Single Point Accountability takes all the guesswork out of who is doing what and puts the construction manager in a place of advocacy for the Owner.

- Design-build also provides a proven team of partners to support a project. The construction partner on almost all GRS jobs is Gilbane, which has influence and experience with local trades in the markets we work in. This creates a sense of partnership when responding to our insurance clients. The low bid is not always the best bid.

- Transparency – GRS provides an open-book invoicing standard not commonly seen on the claims side of recovery. Auditable backup support documentation is central to every claim. There are no surprises for the owner or the insurer.

- Communication – The design-build team has daily meetings with the owner. The GRS model is uniquely focused on providing a timely, cost-effective approach to our clients along with the information to make the most informed decisions in dealing with the loss.

- Owner Control – This collaborative service model maximizes owner control over project scope, costs, and schedule while seeking to minimize conflicts with property insurance settlements.

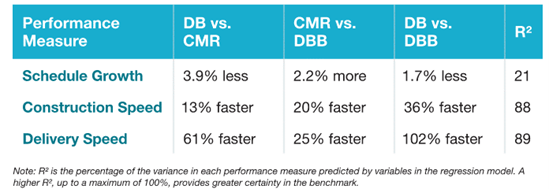

- Time Savings– Design-build is proven to be inherently faster from start to finish because of the factors above. From a period of loss basis, this can significantly reduce business interruption exposure, but perhaps more importantly, return the business to serving its current customer base more quickly.

Source – Design-Build Institute of America

Source – Design-Build Institute of America

Delivery speed is critical in reducing the time of loss. Almost 50% of the claim cost is spent on business interruption. Many companies know that for every hour or every day they are shut down, a value of loss can be calculated. Finding new ways to reduce the period of loss only makes sense. Looking at new ways to manage loss is in the best interest of all parties. Design-build is becoming more popular in modern-day construction, and the benefits of design-build in a post-loss environment should be considered during a holistic review.