What can be done to avoid the “I wish we knew” scenario?

Selecting vendors on a pre-loss basis is much easier than reacting to an event. What that means is having a vendor relationship secured prior to the unexpected will reap countless benefits and help you on the path to recovery immediately after an event.

Some events provide time to react:

- Hurricanes

- The winter melt and potential flooding…

- Wildfires: sometimes there is reaction time, sometimes it’s a panic!

- Transportation strikes

- Pandemic incidents

- Impending droughts

Others do not:

- Earthquakes

- Fire, flood, frozen Pipe, snow load,

- Tornados

- Torrential rains and flooding

- Sandstorms

- Power interruptions/blackouts

- Vandalisms

- Terrorism

- A supply chain vendor had an interruption

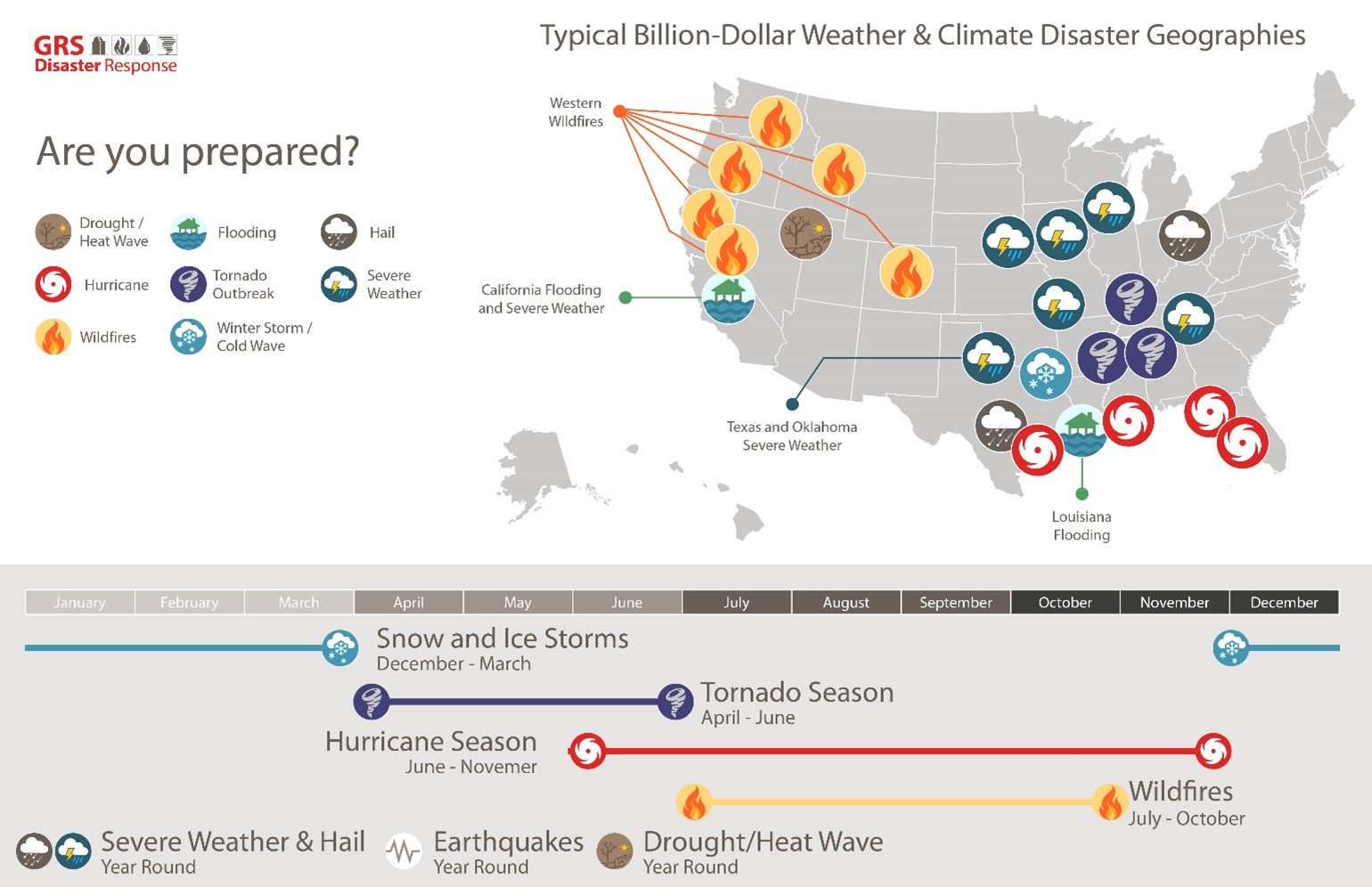

We know many of these scenarios could be a possibility, but it’s never expected to happen to us. We do, however, have a sense of the seasonality of potential events like on the chart shown below.

How do you choose vendors?

The goal should be to fortify your disaster plan with vendors that more likely than not, will be needed after an event. So, how do you choose these vendors? Below are some helpful tips and considerations.

GRS Disaster Response was built to serve the needs of Gilbane clients. Designed to step in and take care of a building that may face the tragedy of a loss via natural hazards or other unfortunate events. GRS delivers a single-source approach to getting facilities operational and reconstructed after disaster strikes. This collaborative service model reduces downtime and maximizes owner control over scope, costs and schedule while seeking to minimize conflicts with property insurance settlements.

GRS was created specifically to bring restoration contracting in line with the processes, procedures, and transparent reporting methods of large, modern, and well-managed construction firms. GRS was formed to provide disaster remediation and reconstruction Services in the most user-friendly, transparent, and efficient manner possible.

Reach out to Jim Wills today to receive the GRS Cares Short Form Pre-loss Agreement and get started on your preparation journey.