Development

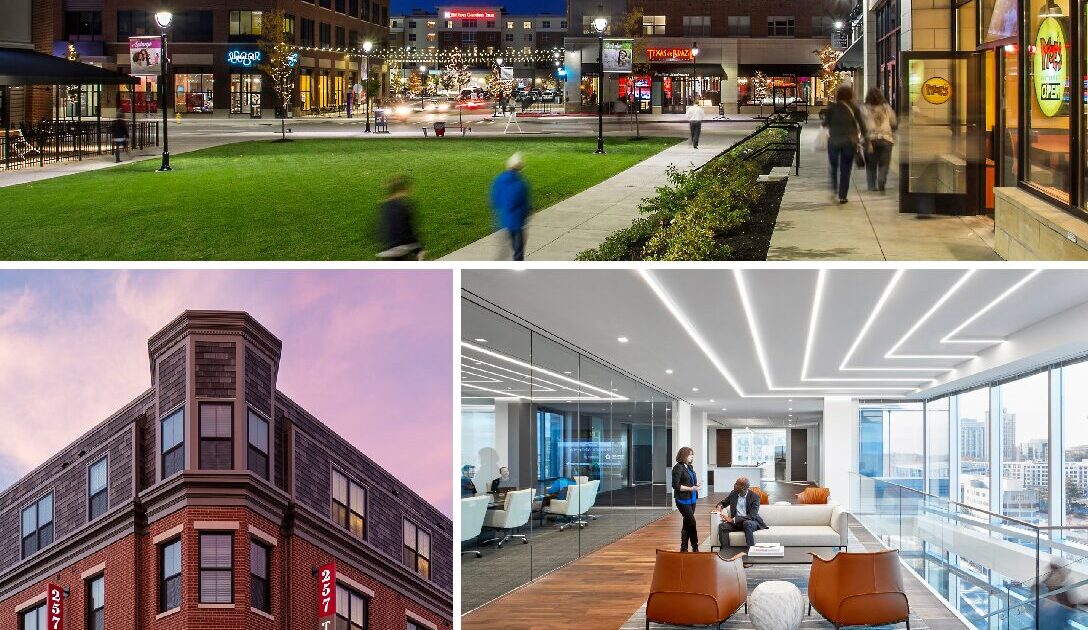

At Gilbane Development Company, we strive to create a sense of place for our residents, tenants, and partners

Developing Dynamic Communities

We offer a full suite of real estate developer services, with the in-house expertise and resources you need to achieve—or exceed—your real estate goals.

Our dedicated, collaborative project teams are highly experienced in executing all phases of project development and working closely with our clients to achieve real estate objectives.

It’s all about achieving maximum value—and enduring assets and communities.

- Project Feasibility Analysis

- Site Selection and Evaluation

- Master Planning

- Zoning/Approvals

- Design & Construction Oversight

- Financing

- Marketing & Leasing

- Property/Asset Management

- Operations & Maintenance

Our Work

Featured Projects

Resources

Insights & Articles

Let’s talk about your project.

Our team would love to talk with you about how Gilbane can add value to your mission.